How to Invest in Nifty 50 from USA?

Want to know how to invest in nifty 50 from USA? The popularity of passive finances is gaining in India. To capitalize in this, fund houses are launching passive price range that track numerous indices.

A few fund houses have launched price range that tune the NIFTY Next 50 index. This consists of Axis Mutual Fund and Navi Mutual Fund, which launched Index Funds that track the NIFTY Next 50 Index in January 2022.

What’s more, there have been already greater than 10 index funds and alternate-traded funds (ETFs) from distinctive fund homes that music the NIFTY Next 50 Index. This truely suggests how popular the index is. In this weblog, we will give an explanation for the NIFTY Next 50 index, its composition, and its returns to help you understand in case you need to invest in this massive-cap index.

What Is The NIFTY Next 50 Index?

The NIFTY Next 50 Index, because the call indicates, is a assorted massive-cap index comprising 50 big-cap businesses that aren't part of the NIFTY 50 Index. Therefore, its elements are the companies ranked 51st to 100th as according to the free-glide market capitalization (shares available for buying and selling within the market multiplied with the aid of share rate).

Read Also: How To Invest in Crypto Without Buying Crypto?

Another way to look at this Index is to take into account all of the agencies within the NIFTY one hundred Index after apart from the organizations which might be a part of the NIFTY 50 Index.

These businesses are called Next 50 due to the fact they could grow to be part of the NIFTY 50 Index at a later date if the inventory plays nicely. Between January 2002 and March 2021, 52 shares were upgraded from the NIFTY Next 50 Index to the NIFTY 50 Index. The most current ones include these:

5 Stocks Recently Upgraded from NIFTY Next 50 to NIFTY 50 Index

| Year | Stock Name |

| 2021 | Tata Consumer Products |

| 2020 | SBI Life Insurance Company |

| 2020 | Divi’s Laboratories |

| 2020 | HDFC Life Insurance Company |

| 2020 | Shree Cements |

On the opposite hand, if a NIFTY 50 inventory performs poorly, it may be downgraded to the NIFTY Next 50 Index. For instance, in March 2021, GAIL (Gas Authority of India Limited) was moved from the NIFTY 50 Index to the NIFTY Next 50 Index. At the equal time, the Tata Consumer Products stock changed into moved to NIFTY 50 from NIFTY Next 50 keeping the quantity of shares regular at 50 in both the indices.

What Are The Constituents Of The NIFTY Next 50 Index?

The weightage of the 50 stocks is determined by the free-drift marketplace cap of the shares, consequently the weights aren't identical. The below table indicates the person weights of the pinnacle 10 stocks (through individual weight) which might be a part of the index:

The man or woman weight of any unmarried stock in this Index is capped at 4.Five%. Moreover, the cumulative weight of those pinnacle 10 stocks bills for round 34% of the index, which extensively reduces the attention chance from a single stock for traders. In this article, want to know What Happens if I Buy Tesla Stock Today 11th March 2025?

The NIFTY Next 50 is rebalanced on a bi-annual basis. So new companies may be covered inside the index with the aid of changing present groups twice a yr primarily based on average free-waft market cap calculation with cutoff dates of 31 January and 31 July of every year.

In the case of the removal or introduction of shares from the 50 nifty united states, a public assertion is made 4 weeks earlier than the alternate comes into effect. Being a different index and you could benefit publicity to more than one sectors through a single investment. The pinnacle 10 sectors wherein you could invest through this index are:

So, as of 31 December 2021, monetary offerings stocks accounted for nearly 20% of the Index. However, the index has large publicity to other key sectors like consumer goods, metals, and purchaser services, which makes it a well-different index. The weightage to unique sectors continues on changing as consistent with the performance of the stocks of respective sectors.

Returns From The NIFTY Next 50 Index

The NIFTY Next 50 Index has brought SIP returns of 15.Forty one% over the 15 yr length. As you could see in the following graph, a SIP of Rs. 10,000 (total funding of Rs.18 lakh) over 15 years might have grown to a drastically larger Rs. 63.95 lakh. However, it is also clear from the subsequent graph, the index has seen a surge in performance because the 12 months 2014.

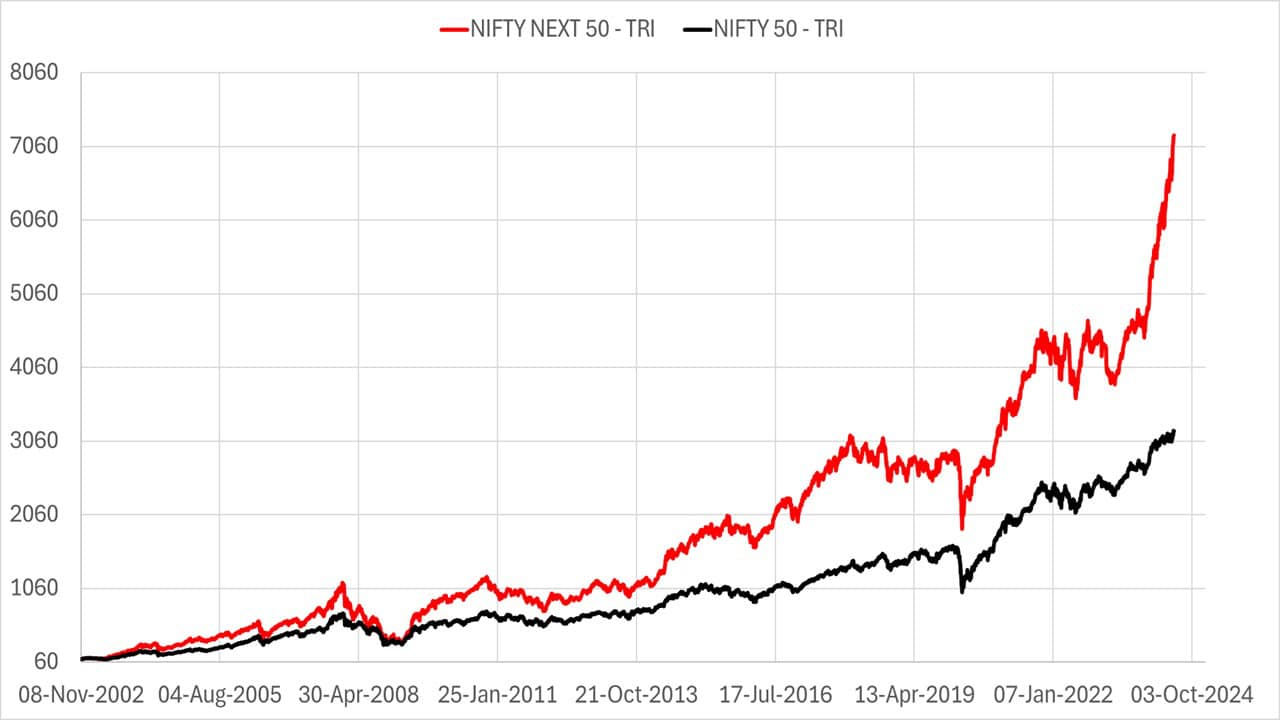

Comparison Of NIFTY Next 50 Index To NIFTY 50 Index

Now as stated in advance, the NIFTY Next 50 Index and NIFTY 50 Index are both huge-cap indices that are a part of the larger NIFTY a hundred Index. However, there's a huge distinction in the size of the corporations of the 2 indices.

As of 31 December 2021, the entire marketplace cap of agencies in the 50 nifty united states became Rs. 134.Fifty four lakh crore, while, the overall market cap of NIFTY Next 50 Index businesses changed into Rs. 37.25 lakh crore.

So, if we ought to do a relative assessment NIFTY 50 stocks account for forty eight% of the full marketplace cap of NIFTY 100 index even as NIFTY Next 50 money owed for simply 23%. The under table compares the 12 months-on-12 months returns of the NIFTY 50 Index and NIFTY Next 50 Index:

As you could see from the above evaluation, during bullish stages, the NIFTY Next 50 Index has in maximum cases managed to outperform the NIFTY 50 Index.

However, during marketplace drawdowns consisting of 2008, 2011, and 2015 the 50 nifty united states has posted notably better losses as compared to the NIFTY 50. The outperformance of the NIFTY Next 50 Index vs the NIFTY 50 Index is likewise illustrated by means of evaluating the rolling returns posted by using the 2 indices over distinctive time periods:

As you could see, no matter the time period selected, the common rolling returns furnished by the NIFTY Next 50 Index have exceeded the ones of the NIFTY 50 Index.

Nifty Next 50 Vs. Equity Funds With Emerging Bluechip Theme

There are a few budget whose names recommend that they also put money into groups that have the potential to end up bluechip shares. Two of those price range are– Canara Robeco Emerging Equities Fund and Mirae Asset Emerging Bluechip Fund.

The investment goal of Canara Robeco Emerging Equities Fund is to spend money on high-boom companies both inside the large and midcap area. Similarly, Mirae Assets Emerging Bluechip Fund also invests in a various portfolio of big and midcap companies.

As both of these finances put money into each Large and Midcap stocks, those budget can’t be handled because the lively counterpart of NIFTY Next 50 index. Both of those funds have full-size publicity to midcap agencies whilst NIFTY Next 50 is a basically big-cap index.

As consistent with SEBI definitions, Large & Midcap Funds must mandatorily make investments as a minimum 35% of assets in huge and mid-cap company stocks. However, evaluating the overall performance of the Next 50 Index to these schemes can assist us decide if the performance of this Index is at par with a mixture of large cap and midcap stocks.

How To Invest In The NIFTY Next 50 Index?

A simple and clean manner to invest inside the NIFTY Next 50 Index is to select an index fund or ETF that tracks this index. However, the challenge of taking publicity directly to NIFTY Next 50 is that your gains.

In addition to losses, could be consistent with the Next 50 index. So, you may in no way be capable of outperform the index. The smart way of making an investment in the NIFTY Next 50 Index while generating index-beating returns is to take ET Money Genius club.

Genius strategies most effective offers publicity to portfolios that put money into index funds monitoring the NIFTY Next 50 index however additionally numerous different indices inclusive of, Nifty 50, Nifty Midcap 150, and Nifty Smallcap 250, to provide multi-stage diversification. Apart from this, each of the 6 Genius techniques will even have publicity to 3 different asset classes– international equities, gold, and debt.

Genius doesn’t really allocate money throughout asset lessons, it follows a dynamic asset allocation method which does wise investing to make certain you're invested within the right asset on the right time for proper tenure.

The multi-asset approach with dynamic asset allocation enables Genius portfolios to capture the upside even as at the identical time presenting remarkable downside protection for the duration of marketplace correction phases. This has helped Genius create alpha for its traders over long term.

This ability to time access and go out into and from exceptional asset classes has helped Genius portfolios beat even actively-controlled equity funds with good margins over the long time.

Therefore, in case you don’t want to be happy with just index-like returns, spend money on NIFTY Next 50 thru Genius. If you want to recognize extra about Genius portfolios.