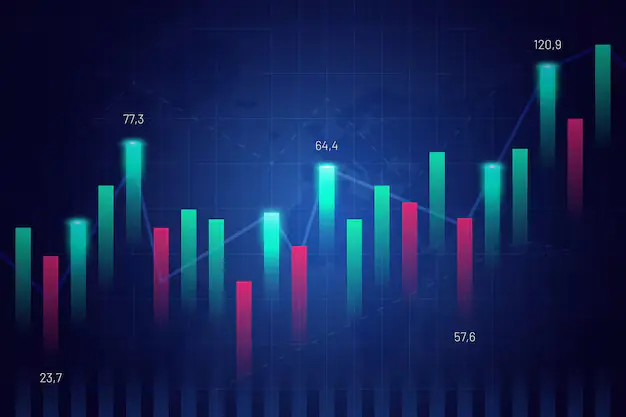

Average Return on Stock Market

What is the Average Stock Market Return?

The average stock market return is a figure that shows the performance of an index over predetermined periods of time. It provides investors with a sense of the index's overall historical performance as well as what longer-term investors could anticipate from it.

It's crucial to remember that while an index may have produced double-digit returns over a number of decades, a single year's performance can differ significantly.

The Meaning of the Average Stock Market Return

The easiest way to define average stock market return is as a computation that looks at returns over a given time frame. Investors can use this information to determine whether an investment is appealing by learning whether it has historically increased or dropped on average.

How is Average Stock Market Return Measured?

An elementary computation can be performed when examining the mean returns of stock markets. To do this, tally up all of the yearly returns over a predetermined number of years, then divide the total by the total number of years.

Average Stock Market Returns Historically

-

While typical stock market returns per month can differ greatly, an annual study may reveal a similar narrative.

-

The historical returns of the S&P 500 are a good example.

-

Over the past few decades, the average yearly return has ranged between 9% and 10%, but the performance of individual years has been wildly inconsistent.

-

Because of this, typical stock market returns don't necessarily provide a reliable indication of what you could get in a given year, according to James Norton, head of Vanguard Europe's financial planners. He added, "From year to year, market returns fluctuate around their averages—sometimes dramatically, as in the case of shares." "However, over the long run, shares tend to return more than bonds and cash, even though they tend to fluctuate more than those assets.”

-

He used the FTSE All-World Index's performance as an illustration. In sterling terms, the average yearly return since 1993 has been 9.3%, but it has rarely reached that amount in a single year.

Average Returns on Stock Markets and Inflation

-

A measure of how prices for goods and services rise over time is called inflation, and it can have an impact on average stock market returns.

-

Inflation frequently has a negative effect since it raises prices across the board and may discourage consumers from making purchases. As a result, businesses will make less money.

-

Unfortunately, because there are so many factors at play, the relationship between inflation and average stock market returns isn't always obvious.

-

For instance, businesses in the energy industry may benefit if inflation drives up the cost of goods that consumers must purchase, like energy.

-

On the other hand, the effect will also rely on whether or not businesses have seen an increase in their expenses.

Read Also: A Guide to Analyzing AI Stock Market Trends

Average Returns on Stock Markets and Their Volatility

-

One of the most important elements affecting average monthly stock market returns is volatility. The degree to which an asset's price varies over time is known as its volatility. Larger price swings are implied by higher volatility.

-

The issue is the well-known volatility of financial markets. All you have to do is examine the average return of the S&P 500. It has returned more than 30% in its best years. Even still, at its lowest point, it lost about 40%. At other times, it hasn't moved at all.

Forecasts for Future Growth in the Stock Market

-

Analysts, investment managers, and economists will all have opinions about where they believe the stock markets will likely go in the coming years. By looking at the shares' recent performance, they will come to these conclusions. Has there, for instance, been a significant rally?

-

According to a Reuters survey, the S&P 500 is predicted to end the year above the 5,000 mark because it is still uncertain when the Federal Reserve would start reducing interest rates.

-

The benchmark US index was predicted by 40 strategists to be at 5,100, which is about where it has been in recent weeks, according to their median prediction.

Conclusion

Although the S&P 500 index has an average annual stock market return of 9% to 10%, the trend hasn't been as consistent during shorter time periods.

It has climbed by over 30% in certain years and decreased by over 40% in others. Additionally, there are several years in which it has not moved at all. Because of this, examining an index's typical stock market returns should only serve as a reference for historical data.